Top 3 Ways AI Enables Lenders To Spot Unseen Risks – and Find Opportunities

Key Points

- Intelligent systems can fast track the process of identifying profitable borrowers and their potential risk.

- AI automates encoding of data from financial documents.

- AI can aggregate information that helps put all analyses in context.

- It enables lenders to perform real-time analysis of data.

The Great Recession heralded regulatory changes in lending practices aimed at protecting banks against losses. The pandemic has revealed that the steps taken to mitigate risk exposure is insufficient and years of low-interest rates have created a dangerous situation for banks whose portfolios are particularly concentrated on commercial real estate.

This is a problem since CRE loans make up a significant portion of many bank’s portfolios and are considered a traditional core business for a great number of community banks. The Federal Deposit Insurance Corp. (FDIC) has identified 356 banks as “concentrated” in CRE based on certain criteria such as the ratio of their CRE loans to capital base.

Due to the economic slowdown caused by the pandemic, debt owed by businesses spiked as declines in revenue increased the need to borrow more capital to weather the downturn. The capacity to pay down debt has also suffered due to weak earnings. The FDIC expects that as households continue to struggle, the instances of loan defaults may rise.

Preservation of value is a top priority for lenders, and many have adjusted their lending practices in a bid to lessen exposure to what many perceive as a highly uncertain CRE market. For multifamily properties, lenders have applied an additional 25% vacancy discount for underwriting, increased the minimum down payment to 40% from the previous 10% to 20% range, or have stopped lending altogether.

During this time of uncertainty, it is crucial for lenders to heighten risk assessment as it can spell the difference between losing money or gaining exponential returns. Artificial Intelligence and its related technologies such as machine learning and automation, can boost lenders’ ability to identify, assess, mitigate and monitor risks in their portfolio. AI’s ability to provide real-time access to market information and swift data processing is a game changer for lenders, especially during times of duress.

CRE Lending During COVID: An Overview

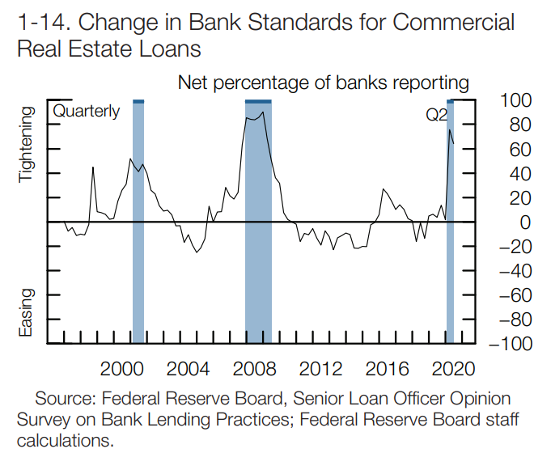

The July Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS), which generally corresponds to the second quarter of the year, showed that on net, many banks reported weaker demand for CRE loans and tighter lending standards.

The October SLOOS report, which corresponds to the third quarter of the year, indicates that the trend continues. Banks tightened standards and reported weaker demand across all three major commercial real estate (CRE) loan categories, the report said, noting that significant net shares of banks increased collateralization requirements, loan covenants, premiums charged on riskier loans, and the use of interest rate floors for both loans to small firms and loans to large and middle-market firms.

Among the reasons cited behind the tightening of lending standards include a less favorable or more uncertain economic outlook, worsening of industry-specific problems, and reduced tolerance for risk. Many banks also mentioned deterioration in their bank’s current or expected capital position and increased concerns about the effects of legislative changes and supervisory actions.

Additionally, delinquency rates on CMBS, which normally contain riskier loans, have also spiked, noted the Fed. Trepp LLC estimated that the U.S. CMBS delinquency rate in October averaged at 8.28%, 64 basis points down from September.

Property Sectors and their CMBS delinquency rate in October:

- Industrial sector – up 46 basis points to 1.53%

- Multifamily – up basis points to 2.95%

- Office – up 21 basis points to 2.49%

- Lodging – down by 351 basis points to 19.43%

- Retail properties – down 43 basis points to 14.33%

Trepp noted that the improvement in delinquency level in the sectors were likely from lender forbearance rather than improvement of performance.

Where Does AI Fit into the Picture?

Lenders need to process a multitude of loans to identify profitable borrowers as well as the potential risk each application carries. Intelligent systems can fast track this process and enhance the quality of data gleaned through aggregating both internal and external data and applying it to models that can extrapolate information and predict future outcomes given set parameters.

One of the main driving forces behind managing a CRE lending program well is data – access to data and real-time analytics to power swift and intelligent decision-making. This is where AI and its associated technologies such as machine learning and automation truly shine.

1. Data Extraction and Standardization

Analysts traditionally spend an inordinate amount of time simply encoding data from property financial documents, such as rent rolls, operating statements, budgets, and appraisal reports, into Excel spreadsheets and inputting it into their system. AI enables automation of this process, which allows analysts to devote more time to analyzing the extracted data and trends. The mundane, tedious, and time-consuming work of data-entry is relegated to machines which are able to not only process data much faster, but also eliminate human error from this process, and thus reduce risk. Additionally, machine data extraction enables to extract an order of magnitude more data from property financial and operating documents, every little detail, which is extremely powerful for risk assessment (the devil is often in the details).

After extraction, data is automatically standardized according to a user-selected chart of accounts (CREFC, Fannie Mae, Freddie Mac, or any other custom chart of accounts). This enables to easily compare property performance with that of other similar properties (as data in different formats across different properties is converted into the same format) and see if there are any discrepancies and red flags.

For example, if a building’s maintenance expense is consistently much higher compared to the average expense for similar properties, then it could mean there is an underlying problem in the building’s structure that needs to be addressed. It could also mean that the building well-cared for and is a good investment. Since the matter has been brought to attention, it is easy enough to investigate.

Hidden liabilities and potential are uncovered easily.

2. Data Aggregation

AI technology can process information at a speed unmatched by humans. It can aggregate information about property location and the local market and put all analyses in context. Even if property documents don’t contain any risk signs, the location data and local market data may provide insight on future issues.

For example, a property located in a small city that is highly dependent on the presence of one or two companies will be severely affected by the shutdown of even one of those companies. A location that is reliant on a single industry will be negatively affected when that industry falls into distress. Even if a property’s financials say it is doing well, it will likely still be affected by such developments.

Factors such as significant office vacancy in nearby buildings is also worth monitoring as it will likely lead to tougher lease negotiations or lead to an increase in vacancy in the building in question. AI technology looks into location specifics, property characteristics, and can extrapolate information based on the performance of other properties in similar locations.

AI’s ability to aggregate this information quickly and efficiently, as well as transform them into interactive visualizations, helps analysts get a clearer picture of the property, its potential, and pitfalls, and better analyze external risks, facilitating better decision-making about the property and the loan.

SpaceQuant’s technology, for example, can provide deep insights based on data from 120+ million buildings and locations – bringing all essential information in one place. The platform aggregates many traditional and alternative data streams to provide a digitalized insight of a local broker to enable hyper-local, ultra-granular benchmarking and insight impossible before.

AI doesn’t deal in anecdotal information but aggregates hard facts from property financials, rent rolls, tenant leases, concessions, costs, rents, and vacancies – all these are accessible, down to a particular property or submarket. Technology enables the extraction of these data and its storage in databases at scale.

3. Real-time Analytics

With an AI-enabled cloud-based platform, lenders can perform real-time analysis of data, allowing them to uncover critical information at a speed impossible to achieve before.

AI brings automation and enables hyperlocal, ultra-granular analysis, allowing institutions to determine levels of risk exposure per location, per tenant, and per industry. Lenders can quickly spot where there is a higher risk of tenant non-payment or bankruptcy and design proactive measures accordingly.

For example, if a retailer like Pier I Imports announced that it is closing its stores, an AI-powered platform can easily process the data in a lender’s records to figure out which loans, portfolios, and securities will be affected by the shutdowns and by how much.

Similarly, lenders can also see their risk exposure to certain sectors such retail, which has been weakened by the restrictions placed on movement due to the pandemic. Lenders can assess the likelihood of bankruptcy and make decisions quickly.

With AI technology, lenders can keep track of information such as lease changes across buildings, and across portfolios. The ability to act swiftly, especially now when a great number of businesses are scaling back their operations or closing permanently, will allow lenders to lay down measures to mitigate risks and save capital.

Correlation of Property and External Data

AI’s ability to correlate property data with external data, coupled with analysis of patterns from prior market dislocations, can help uncover risks that are hard to see for a human analyst. The human brain can only operate seven data points at the same time. Machines have no such limitations and can analyze complex relationships in real-time.

AI uses predictive modeling to ascertain the likelihood of property value changes using data taken from the performance of similar properties over a given period. The software also helps analysts identify riskier propositions. Take two similar office buildings, the building that houses many small businesses as tenants will face more difficulties during times when the economy is distressed as SMEs are more vulnerable to market upheavals than larger, more established companies with deeper cash reserves.

Meanwhile, multifamily assets perform better in more densely populated areas than in suburban locations. However, given the current trend of urban flight due to the pandemic, this may change in the short- to medium-term.

AI technology leverages data to power analyses. The more data, the better trained the software. SpaceQuantprocesses thousands of properties each quarter, making it one of the largest analytics and transaction management companies in commercial real estate. Our AI has been trained on thousands of datasets and as we continue to process even more information, the smarter our AI will be, and the more effective at parsing information.

Conclusion

AI and its related technologies, such as machine learning and automation, are transforming the traditional lending processes with their unlimited potential for value creation. It is already being used in loan origination and servicing.

AI is also transforming risk assessment in finance with its ability to deliver real-time information, enabling swift and proactive decision-making. We are already seeing banks adopt AI in their data management systems due to its ability to handle complex data sets and parse information.

The trend is clear – more and more companies are adapting the technology and leveraging the transformative power of AI.